Loans

Loans for homes and vehicles are generally secured, which means that the home or vehicle is attached to the loan. Secured loans can also be for furniture, computers, white goods, boats and caravans. If you default on repayments, the lender can repossess the home.

Unsecured loans include personal loans and credit cards. If you default on the loan, you can be taken to court and a judgement made against you to sell some of your assets or garnish your wages to repay the loan.

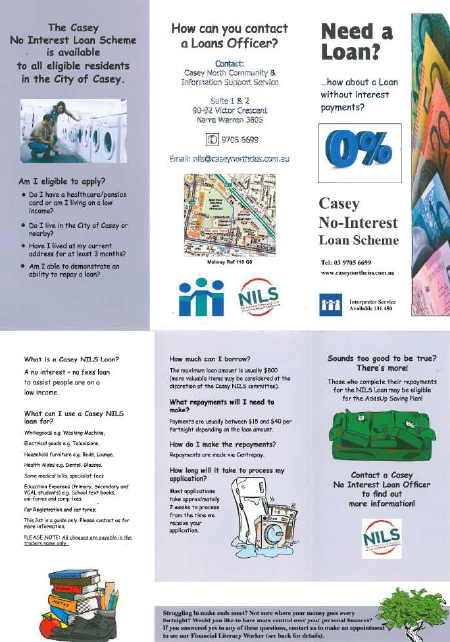

The No Interest Loans Scheme (NILS®) provides interest-free loans for individuals or families that have a health care card or a pension card and receive a centrelink payment and are on genuinely low income. They are generally for the purchase of essential items like a fridge, washing machine, TVs, bed, clothes dryer and health aids.

- Before you get a loan, do a budget to work out what you can afford. DO NOT rely on the lender telling you what you can afford. Don't assume you can afford a loan just because a lender is prepared to give it to you.

- Don't borrow more than you need.

- Shop around for the best interest rate you can get.

- The contract must state the total amount to be repaid over the life of the contract.

- You will be locked into making repayments for the length of the contract.

- Because of interest, your repayments will add up to a large amount of extra money compared to the amount you borrowed.

- If you repay early you will save money although there may be penalties charged.

- If you face financial hardship and have difficulty making repayments, immediately talk to your creditor or get help from a financial counsellor.

Car Loans

Loans for travel and other fun stuff

- before you sign

- look at the interest rate. Loans are available from most financial organisations such as banks and credit unions.

- how long will it take to repay?

- add up the total cost. Do a budget including all the costs involved such as loan repayments, registration, fuel, insurance and car maintenance. then YOU decide if you can afford the loan.

- can you afford it? Do not be pressured by car salesmen into buying what you can't afford.

- is there a better rate at another lender? Car dealers often arrange finance or insurance for you. Do not accept these arrangements unless you have tried to arrange them yourself and can't do better.

DO NOT rely on the lender telling you what you can afford Don’t borrow more than you need Do you need HELP?

If you are 2 payments behind, the finance company can repossess and sell the car to pay back the loan. If the selling price is not enough to cover the loan, you are responsible to pay the difference as a unsecured debt.

Be particularly careful when you buy a new car. The moment you drive one out of the showroom, it is worth much less. If you cannot afford the repayments and the car is re-possessed, you may be left with a big debt and no car.

If you are in difficulty repaying your debts, you can ask the creditor for permission for you to sell the car privately. You may get more money this way but you will only be given limited time.

Tips

Save as much as you can before you buy. Bigger deposits mean smaller loans and repayments. If you are eligible for a unsecured personal loan, check if it may be cheaper than a car loan.

Advertised Interest-Free Loans

Be very wary of taking one of those loans. The company providing the loan is not being specially generous towards you and still has to make a profit. The way they do this is usually by charging a much higher price for the item or goods supplied. You may pay double the market price or even more. You will usually be much better off to get a normal loan to purchase the goods at the best possible price and pay interest.

Tips

If you are considering one of those interest-free loans, do your homework first.

Check the price being charged for the goods, then find out the true market value of the goods. See if you can buy something similar for a much lower price with a normal loan, then compare the total payments you make for both options.